The Top 2021 Markets for Commercial Real Estate Investing

by Christopher Levarek

“The goal is to turn data into information and information into insight.”

- Carly Fiorina

It used to be we waited for the newspaper to provide our daily news on how the city, economy or even world was doing. Today, our mobile devices flash to give us realtime updates on every little tidbit of information, screaming for our attention like a newborn child. Data is at our fingertips and that matters in real estate investing.

Having up to date information on market trends and cycles let’s us forecast with ease our next move. With all of this information available, we are able to pick and choose our entry points in a market while limiting our risk as much as possible. So which data sources for real estate matter? Which ones should be considered?

In my opinion, reports/data on commercial real estate investing should be reviewed at least quarterly if not monthly for updates from these top sources :

Let’s look at one of my favorite reports from IRR.com showcasing the performance of various markets for 2021 in commercial real estate investing. It showcases end of the year, beginning of year and midway through the year for market trends across the United States.

To start, these reports have markets classified and ranked as being in a state of Expansion, HyperSupply, Recession or Recovery as viewed below :

Source : IRR,com

The report then breaks down markets according to these criteria in various asset classes.

Here are the following for the IRR “Mid-Year 2021 Viewpoint Report” :

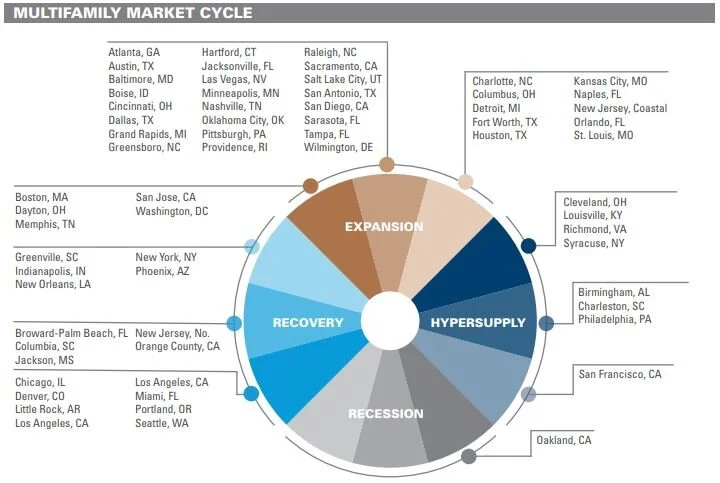

2021 Mid-Year Viewpoint Market Cycle - Multifamily

Source : IRR.com

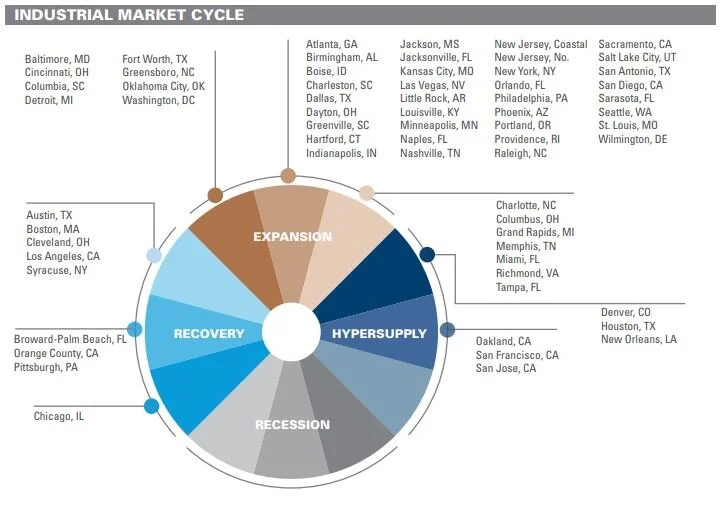

2021 Mid-Year Viewpoint Market Cycle - Industrial

Source : IRR.com

2021 Mid-Year Viewpoint Market Cycle - Office

Source : IRR.com

2021 Mid-Year Viewpoint Market Cycle - Retail

Source : IRR.com

So, What are the Top 2021 Markets ?

It depends! As is clear, the markets vary according to asset class. However, If we just look at the markets in the highest expansion, the top 2021 markets at present are :

Multifamily

Boston, MA

Dayton, OH

San Jose, CA

Memphis, TN

Washington D.C.

Industrial

Baltimore, MD

Cincinnati, OH

Columbia, SC

Detroit, MI

Fort Worth, TX

Greensboro, NC

Oklahoma City, OK

Washington D.C.

Office

Austin, TX

Nashville, TN

Sarasota, FL

Retail

Boise, ID

Raleigh, NC

In Final

There we have it, the top 2021 markets at present mid way through the year. With this information, a passive or active investor can now have a starting point for looking at a market or developing an investment strategy.

Of course, we’ve only listed the top performers for Expansion above. Indeed, many of the markets listed in any of the expansion categories/colors are showing great numbers and should be considered as well. There is even the potential of entering into a market in a developed/late Recovery(light blue) and riding the wave back up.

It’s the categories of Hypersupply, Recession and early Recovery(dark blue) that should be questioned. These markets require much more detailed data to ensure a good investment thesis and much more due diligence on the sub-market performance.

I hope this information has been valuable and I highly recommend visiting some of the recommended resources to really get a better “viewpoint” on market trends. Happy Investing!