Why You Should Invest in Real Estate during a Recession

by Christopher Levarek

“We don’t Learn much when everything goes Right. We Learn the most when things go Wrong.”

- Simon Sinek

I dropped out of college, sold my belongings and move to France in the summer of 2003. I was shy, nervous and scared about what the future held. Many of my friends thought I was crazy.

In fact, France was the arch enemy for many Americans at the time, as they refused to support our administration’s decisions to invade Iraq. Bush was advocating, “Freedom Fries” instead of French fries for one and it was an interesting moment in history to say the least. I digress.

Little did I know, this experience would not only be the most challenging part of my life journey but indeed be one of the most rewarding. In my life. It completely eclipsed my expectations and what I was capable of.

I ended up spending two years in the South of France visiting the countryside and learning more then any University in the United States could of taught. I even studied for and received a Business Diploma in International Trade completely taught in French and of course incidentally learned to speak French fluently.

I’m sure you have a similar experience in your life. A time when you did something different from the crowd. A time when you looked left while everyone was looking right. Often in these moments we are surprised and gifted with amazing opportunities or experiences that change us for the better.

Now, this is exactly what I want to talk about regarding real estate investing today. This idea of looking left while others are looking right. Today, we find that the market is ripe with fear. Many are afraid of inflation, rising interest rates and an existing or upcoming recession.

Now is the time for looking left. Now’s the time to invest in real estate. Follow along as I show why…

Fear : What’s on the Other Side?

It is the month of September in 2022 and people are scared. Although we just survived a pandemic for two years, many are afraid that this is the end. The end of a financial era and the ultimate decline of our economy.

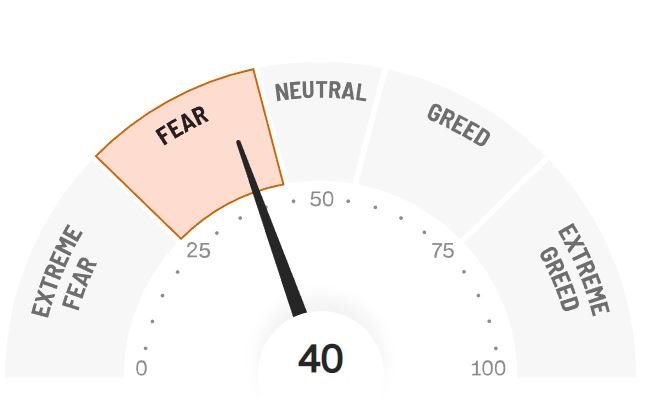

September 2022, Source : CNN.com

Search in Google for “Fear & Greed Index” and you’ll see just how much the stocks and crypto markets are showing fear based on existing markets.

Yet, do you know that for every up, there must come a down. Markets and economies rise and fall, this is a certainty. It’s been the case for decades and it will continue to be the case for many to come.

So what can you do it about it? What can you control? What lies on the other side of this fear?

Opportunity.

Yes, there is opportunity on the other side of fear. Just like that opportunity I had to travel to Europe for two years even though I was scared stiff of the journey. I was so scared, yet it turned out to be one of the best experiences of my life.

Remember, when everyone is afraid, if you take action, you might just find opportunity. For example, we are currently under contract on a property on the beaches of North Carolina.

It was listed at $1,069,000.

We are set to close for $876,000.

Now this is called opportunity and it was found by not only fixing the seller’s problem but more importantly because nobody was buying as they were caught up in their fear.

So, move through to the other side of fear and be surprised at what you find!

Recession, What Recession?

Did you know that investing in 2012 could have made you a millionaire? If you had invested $10,000 in the stock market in 2009 alone you would have made a 582.13% return in the stock market. or a 15.92% return annually if you sold the stock in 2021.

Did you know the median home price in San Jose, CA in 2012, when the market was recovering from the 2008 recession, was $638,300?

Did you know the median home price in San Jose, CA in march of 2022 was $1,427,500?

In 2008 the markets collapsed and fear was rampant. A recession was in progress. Many did not know when or if it would end. However, there were some who took action and looked left.

Investors bought up real estate in foreclosures and short sales from 2009, 2010. 2011 and 2012. These investors would, for many, become multi-millionaires. Many of these investors are even now leaders and advocates of real estate on Biggerpockets such as Brandon Turner or David Greene.

Others who invested in businesses, stocks and real estate in 2009-2012 are even more well known such as :

Here’s the point, recessions are going to happen. It is up to you to decide to be ready and take action. Opportunity is found in the up cycle and in the down cycle.

Are we in a recession? Yes, in my opinion and according to the definition of recession, that being negative GDP growth, we have been in one for two quarters now. Yet, now is the time to seize opportunity and find those home run investments.

Now is the time to take action and invest in real estate during a recession, not after.

In Final

I’ll close with this image which showcases a price history for a property in Kissimmee, FL. If you don’t know, we own a short term rental in this same neighborhood as this property and I have made multiple offers on similar properties since early 2021. All to say, I am familiar with the market.

Now, we originally purchased our property around the $625,000 range in late 2020. When prices climbed well over the $750,000 range, we turned to other markets in mid 2021.

You can see in four months of recession, prices are falling again to more reasonable numbers simply based on the image.

These recent purchase numbers are very close to what we purchased at back in 2020! These numbers are homeruns or base hits for the right investor. Prices are falling because people are afraid to buy and interest rates are higher.

Now is the time invest smart. Buy right and run the numbers. Or invest passively with the right group.

If a deal doesn’t make sense financially or numbers wise, don’t do it. Yet, by all means, do not simply take no action.

Now is the time to take action and look left, when everyone is looking right.

As always, reach out if we can help. Our team is actively buying and opening up investment opportunities for those in the Valkere Investor Club. So join in if you are interested in passively investing alongside us.

Until next time, Happy Investing!