LGBQT - A Real Estate Market Niche?

By Christopher Levarek

“Don’t find customers for your products, find products for your customers.”

-Seth Godin

When marketing a product or in the case of real estate, finding investors/buyers/renters for property, it will always be of great benefit to understand who your target audience is. If you do not understand your target audience then how can you create a product which aligns with their needs?

Quite often many investors seeking real estate markets or investment property, look at natural appreciation averages for a city and begin a haphazard buying approach in that market. This unfortunately does not allow the investor to fully take advantage of all the data nor maximize the true potential in any market to achieve their goals.

Today, we would like to encourage investors to look at other indicators as well as define their market niche or target buyer/renter by examining a specific group which has been growing and revolutionizing certain cities or real estate neighborhoods, LGBQT.

What Does The Data Say?

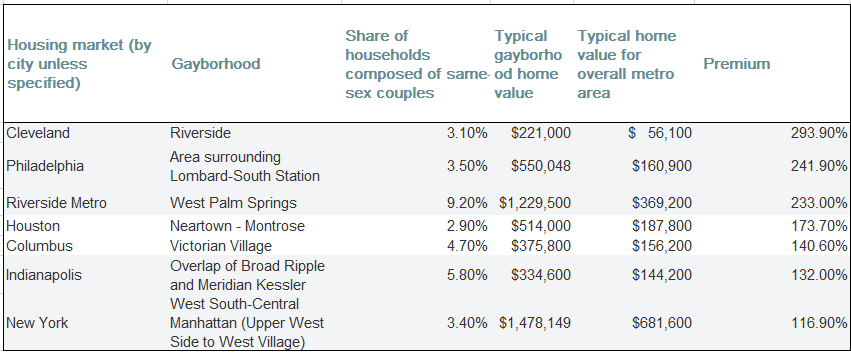

In a recent article by MarketWatch, “the premium to buy a home in a “gayborhood” can be almost four times the typical home value for that metropolitan area”. This data was gathered from a Zillow study which examined communities with the highest share of same-sex couple households.

Typical home values for the metro area of New York were around $681,600 while typical gayborhood home values were valued at $1,478,149. In West Palm Springs, California, “the average cost of a property is 233 percent higher than in other parts of the Riverside County area.”, reports Newsweek in a similar article on this same subject.

Why Is this the Case?

This data trend or disparity in prices relative to the LGBQT could be related to a number of factors. According to Marketwatch, in most cases, gay couples tend to have fewer children then heterosexual couples, which means more disposable income. Additionally, “neighborhoods with large LGBQT communities have long provided fertile ground for tech hot spots and gentrification, as they have often been identified as more open-minded.” reports Newsweek.

In other words, tech jobs and new businesses jointly occupy the spaces of LGBQT communities and seem to be in direct correlation to one another. This leads to market growth, higher job employment and high-paying jobs thus further driving property prices in positive directions.

What does this Mean for the Investor/Agent?

Similar to looking at the Amazon or Apple HQ2 locations to predict market growth, see our recent post, such market indications can be great predictors of real estate niches and opportunities. Additionally, if the focus is on a product which aligns with these indicators such as the data shown by the LGBQT communities, the neighborhoods and investment owners will both benefit.

Just as one might buy a condo in a vacation hotspot, an apartment complex next to a University or a single family home with good schools nearby, understanding your target audience and aligning with a product which matches produces powerful results.

We invite our readers to look at the following article, “Top Places for LGBTQ Folks to Live” by Realtor.com for a look at the top cities in the U. S. currently representing the LGBQT community and considered the most fun friendly places to live.

In Final

Having a defined market niche and target audience is highly important piece to success in real estate investing. With such knowledge and goals defined, opportunities are available which will allow for maximum potential and success for the investor. As always, Invest Smart!