6 Online Real Estate Market Analysis Tools

By Christopher Levarek

“Buy real estate in areas where the path exists and buy more real estate where there is no path, but you can create your own.”

- David Waronker

Choosing where to invest requires due diligence, especially if the market is not local to the investor. When vetting an apartment syndication sponsor deal or exploring investing “out-of-state” to one’s primary residence location, certain resources can help confirm a good or bad location for real estate.

A good real estate market for investment is defined by certain categories to include population growth, low unemployment and job diversity. For further depth on selecting a good market, see our article “What makes a Good Real Estate Market”.

In this post, we will be sharing some online free resources to confirm or help define the variables or positive indicators making a good market.Each of the below resources provides data enabling the investor to validate the selection of a market or confirm the quality of the investment location. Let’s jump in :

Statistical Atlas

This tool can be used to verify a wide number of Demographics, Income and Education statistics of specific areas for given markets. This can be especially useful for understanding household incomes and if projected property rents are reasonable in comparison.

2. City-Data

Similar to the Statistical Atlas, this online resource gathers information from multiple private and government sources to provide detailed informative profiles on every city in the United States. Enter in the City of the desired real estate investment and get a quick overview of categories such as population, crime, ethnic makeup, etc.

3. Bureau of Labor Statistics

An official website of the United States government, this site provides information on a wide range of topcis to include Inflation, employment wages, unemployment rates and even consumer expenditures.

4. FEMA Flood Map

The official public source for flood hazard information, this tool allows one to enter in an address or location by longitute/latitude and determine if that property or real estate is in a flood zone. This can be especially useful to know before you buy.

5. CBRE Cap Rate Map

Every year CBRE puts out Cap Rate Survey reports exploring cap rates for commercial real estate across the United States. In the above link, they have added this information to an interactive map allowing an investor to see how cap rates are doing in major cities as well as trends for that year. The official Cap Rate Survey for 2019 H2 can be found here.

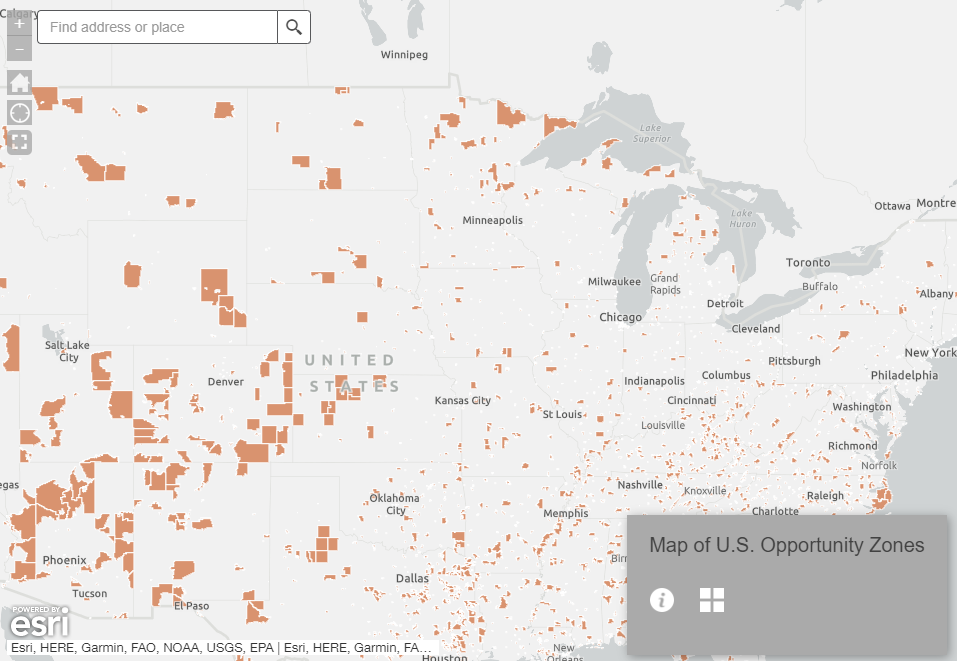

6. Opportunity Zone Map

Opportunity Zones, or areas the government has encouraged investment through tax incentives, are listed on the U.S Department of Treasurey website however the above link “Opportunity Zone Map” by EIG.org has an interactive map which allows an investor to quickly pinpoint if an investment is in a Opportunity Zone.

In Final

There are a number of great online resources which have drastically changed the real estate investing world since the Internet came on the scene. The above are just some of the resources that can quickly enable an investor to perform some due diligence on a location for an investment. In a follow up article, we will cover some more specific tools for due diligence with regard to specific asset-types such as multifamily or single family. Invest Smart!