How the Savvy Investor uses Property Depreciation to 10X Wealth Creation

By Christopher Levarek

“I pay tax, and I pay federal tax, too. But I have a write-off, a lot of it’s depreciation, which is a wonderful charge. I love depreciation.”

- Donald Trump

In the presidential debates of 2016 in the United States, there was an exchange between presidential candidates, Hillary Clinton and Donald Trump, which caused a sensation leading to the video going viral. This video shows Hillary stating how Donald Trump “paid nothing in federal taxes”, to which Donald Trump replies, “That makes me smart”.

Now political and personal character opinions aside here, Donald Trump is highlighting the power of depreciation and write-offs which offset his business costs, taxes or losses. How does this work? Today we outline the power of depreciation and why this is just another massive benefit to investing in real estate to which an investor should be aware.

Depreciation - What is it?

Depreciation is an accounting process used across the business world to represent the loss in value of an asset over it’s useful life. Real estate and real estate related assets depreciate over specific terms, meaning there is a decline in value over time. This makes sense as real estate property materials degrade and succumb to wear/tear over the years, thus allowing one to account on financials for such “value loss”.

Two Methods of Depreciation

There are two common methods for depreciating assets in real estate:

1.Straight-Line Method

Real estate property depreciation with this method is typically calculated over 27.5 years for residential and 39 years for commercial real estate. An easy method to discover depreciation amounts is to simply divide the purchase price by 27.5 or 39 years, residential or commercial respectively, which will equal the yearly amount available for depreciation.

Example:

Purchase Price : $1,000,000

Useful life : 27.5 years

Depreciation(reduction) amount on taxes yearly: $36,363.63

2.Accelerated Method

Source: Engineered Tax Services

This method allows a real estate investor or property owner to depreciate assets over a much shorter useful life span. Typically, assets will be depreciated over 5, 7 or 15 years instead of the original 27.5/39 years in straight-line method. This requires usually what’s called a “Cost-Segregation” study ranging from $4000 to $20,000+ per property, varies on size, but which can greatly benefit a wealth creation strategy.

Example

Purchase Price: $1,000,000

Useful Life(Accelerated): 5 years

Depreciation(reduction) amount on taxes yearly: $200,000

Accelerated Depreciation Method or Cost Segregation

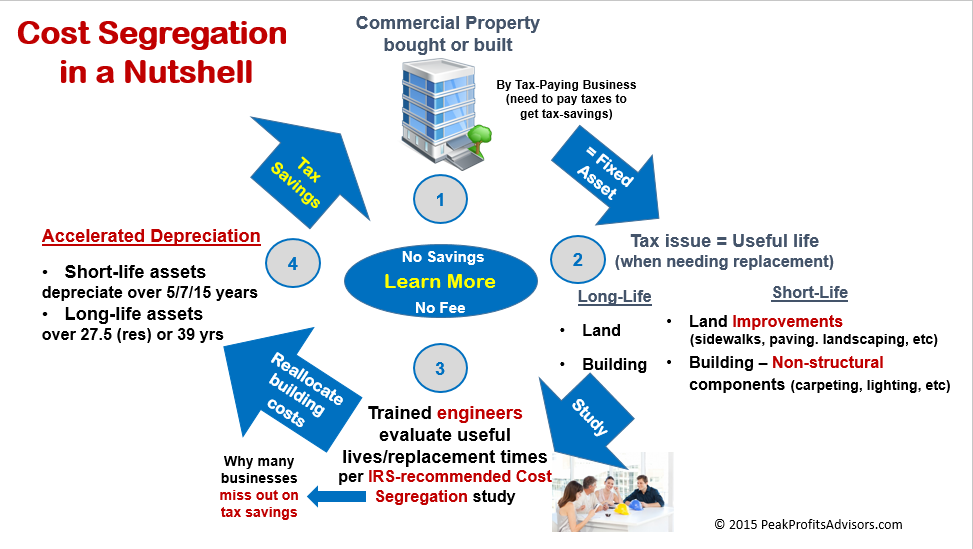

As mentioned, in order to utilize the 2nd method, typically a property owner will get what is called a “Cost Segregation” study. According to the IRS, “cost segregation studies involve the allocation (or reallocation) of the total cost (or value) of property into the appropriate property classes and recovery periods in order to properly compute depreciation deductions.”

In other words, cost segregation is the process of identifying and separating out personal assets for tax reporting purposes related to a property. Typically, a property owner will work with a specialized company in cost segregation who will walk/review the property to identify/reclassify personal property assets for shorter depreciation time periods. Here we include a typical example Cost Segregation Study from a specialized company. Note the assets being depreciated over 5 years instead of the normal 39 years in commercial property:

Source: CSSI, Cost Segregation Services Incorporated

Big Picture on Accelerated Depreciation : What does It Mean and When to Use?

What?

Clearly there is great benefit in accelerating depreciation on a property. Investors will often use this method to offset or write-off other taxable income such as other business income or other property sales for the year. Rather than have the depreciation stretched over 27.5/39 years, an investor is able to realize the depreciation much faster to be able to utilize the benefit in the shorter term. More taxable deductions means more usable income not being paid in taxes for that year and opportunity to reinvest or proactively use the newly available income.

Source : Peak Profits Advisors

When?

Purchase Price Limit : Due to the higher cost of Cost-Segregation Studies, it usually is more beneficial on property acquisitions of at minimum $500,000 with a preferred purchase of over $1,000,000. Anything lower than the minimum or the preferred amount most likely wont have as much value due to the high cost of the study.

Business/Passive Income : Depreciation can be used to offset Business Taxable or Passive Income from other businesses/income which are taxed differently then an investment property might be. Some larger net worth individuals will purchase real estate each year simply to be able to deduct or depreciate against other business income.

Investing Strategy : Accelerated Depreciation can play into a specific investing strategy in many cases. An investor who is in the value-add apartment or multifamily space and looks to renovate and re-sell commercial property in a 5-7 year period would greatly benefit from being able to realize the depreciation during property ownership. Typically, apartment investors will look to sell in year 5 or 7 and thus aim to get all the depreciation benefits through years 5-7 or using accelerated depreciation methods.

In Final

Depreciation is major benefit to real estate investing. Clearly there are advantages and discussions to be had around the subject. We recommend consulting with a CPA and/or meeting with cost segregation specialists to explore options. As always, Invest Smart!