MULTI-FAMILY INVESTMENT OVERVIEW

We are partnering with our friends at Rise48 on this multi-family portfolio investment opportunity for Value-Add Apartment Complexes throughout the greater Phoenix metropolitan area.

The 2-year preferred equity fund targets 6 existing properties in the Phoenix market. This portfolio investment is designed to provide diversification and higher immediate cash flow to investors and is backed by well-performing assets with a proven track record.

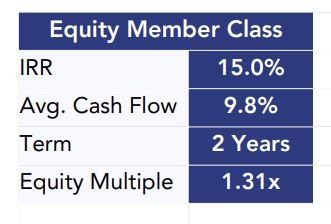

We expect the investment will generate an average cash on cash return of 9% for the preferred equity investors. We’re targeting a 2-year investment horizon with an expected IRR of 15%.

We are excited about the diversification and low execution risk of the Phoenix Portfolio, and we will be investing our own capital alongside our investors.

Benefits of the Rise Preferred Equity Fund

· Immediate 7-8% cash flow

· Diversification across 6 performing properties in Phoenix MSA (1,433 units)

· Quick return on invested capital - 2-year term

· Preferred position in the capital stack (Priority position behind senior lender)

· Low execution risk and high probability of predictable outcome

Deal Timeline:

Funding Due: 8/25/25

Fund Closing: 8/29/25

The Investment Opportunity is structured in the following manner:

Opportunity Terms:

Partner Investment

Average Annual Return on Investment – 15% return

(Profit from Sale in 2 Years + Cash on Cash Return)

Average Annual Cash Return - 9% return

Paid Quarterly by Direct Deposit

Two-year hold

Property updates quarterly

Min investment:

$50,000 minimum total investment

First-come, first-served basis

Max Investment

$250,000 maximum total investment

Open to Accredited Investors Only

To be considered an accredited investor you must satisfy at least 1 of the following criteria:

A natural person with an income exceeding $200,000 in each of the two most recent years or joint income of $300,000.

Or a natural person who has an individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of purchase, excluding their primary residence.

Or an entity with over $5M in assets, or all owners of the entity must be accredited.

Or an individual carrying a Series 7, 65 or 82 designation.